Create a wealth when you come back to India

Even a small investment of 50000 can become a large fund corpus of 10000000 in long term – Build wealth now

FAQ

What is the eligibility to open an NRE or NRO account ?

- To open an NRE / NRO account in India the citizen needs to have lived outside India for a period for 120 days or more . They also should have spent less than four years of the last 10 years living outside India .

Can a Student open an NRE or NRO account ?

- Yes, Students overseas can have a NRE or NRO account .

Do I need to have a PIS ( Portfolio Investment Schemes ) ac for investing in stock market for long term ?

- No, You can open a NON PIS ac with any banks that will be your NRO ac & It will be opened by your affiliated bank , Please contact your bank to open a NON PIS NRO ac for long term investment .

NRI allowed to trade in derivatives , Intraday , F&O Market ?

- No directly it’s not allowed, NRI can only trade in cash market preferably long term investments , NRI have to take delivery of the stock purchased .

What are the taxation ?

- Any Profits derived after selling of stock within 1 year is Short term capital gain taxed at 15 %

- Any Profit derived after selling of stock after 1 year is Long term capital gain taxed at 10% ( Pls Note exception limit is 1 lakh ) ie : Profits made above 1 lakh will be taxed at 10% in LTCGT

What do you suggest to NRI ?

- If you want to make it hassle free investment then we suggest you to open a NON PIS NRO ac for long term investment with your bank. First step is to open a NON PIS NRO ac with your bank then contact any broker that you want to open a Demat ac in India with your NON PIS NRO ac which you can operate from anywhere in the world using Netbanking .

Final Thought :

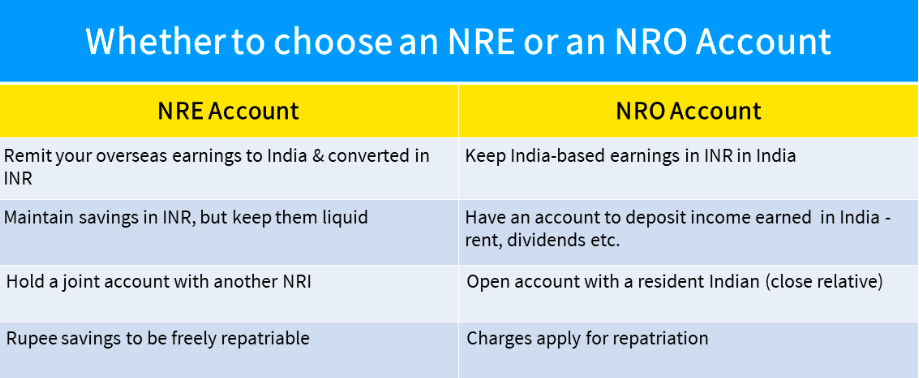

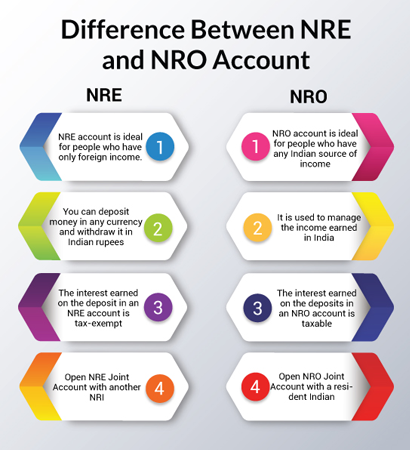

If he person earned from overseas they have to open an NRE account however with regards to investing in India a person has to open a NRO account to invest hassle free

What are the Basic Documents required to open an NRE or NRO ac ?

- Identity Proof ( Copy of Pan, Passport )

- NRI status proff ( Copy of Visa, Work Permit , PIO, OCI )

- Proof of residence abroad

- Indian Address proof

- Canceled cheque

- PIS permission letter

HOW TO OPEN A DEMAT AC AS AN NRI WITH ZERODHA ?

- Opening ac with Zerodha is an Offline process to know the complete process click here

HOW TO OPEN AN NRO NON-PIS AC ?

- To know the process click here

Still have questions, email us on nri@elongateglobal.com